We all know that the US, Switzerland, and China come across as worldwide leaders in software development. In general. But if we take a closer look, we’ll find out that Eastern Europe set the foundation of the modern approach to software development outsourcing. Eastern Europe’s market will likely reach USD 5.34 billion in revenue this year, and is expected to hit USD 7.4 billion by 2030.

There are several reasons for this:

Strong tech and engineering education (including radio electronics and integrated circuit design)

Locals are adaptive and flexible in terms of problem-solving

Rates are more affordable compared to Western Europe and the US

Central/Eastern European time zones sync easily with European work hours and still work for parts of the US

Cultural and business norms feel familiar to Western clients

This article ranks the top five countries for IT outsourcing in Eastern Europe. We break down the complex comparison system into edible, small parameters: education, talent, value, innovation, rates.

1. Ukraine

When foreigners hear “Ukraine” in the tech context, they usually imagine a skillful yet affordable workforce. There is a common bias in IT outsourcing. Eastern Europe is usually cheaper in terms of costs, but there are more risks. Yet, your company can even learn from some countries how to work under real pressure. But let’s eat this elephant bite by bite.

Tech talent and education

Strong CS/math lineage dating back to the Soviet era.

Yet, Kyiv Polytechnic Institute (KPI), Taras Shevchenko National University, Lviv Polytechnic, Kharkiv National University of Radioelectronics, and other universities that appear in the QS World University Rankings 2025 didn’t freeze in Soviet educational programs.

Despite some old-fashioned approaches, these institutions invite Senior practitioners from the Ukrainian tech industry to give lectures and teach the youth what matters.

This is not to mention private schools like Mate Academy, GoIT, EPAM University Programs, and SoftServe IT Academy, which keep mid-level talent current in cloud, data, and product engineering.

Developers and STEM pipeline

As of 2024, Ukraine has 250K+ tech specialists living and working exactly in their homeland; some studies put the figure above 300,000 even after wartime relocations (varies by source and counting method: payroll vs. tax residency, etc.).

Also, it’s worth mentioning the Ukrainian government's reservation program: companies critical to Ukraine’s economy can “reserve” their workers from mobilization. That’s why some technical specialists (not only technical though) came back home and got reserved.

Annual tech/STEM graduates are commonly reported in the ~15,000+ range from technology universities (baseline pre-war cadence sustained via hybrid formats).

Notable universities and regional hubs

KPI (Kyiv): Strong in systems engineering, embedded systems, and enterprise SW research. Influential within the Ukrainian tech community. Regarding worldwide recognition, QS and THE list KPI among Ukraine’s top technical schools.

Taras Shevchenko (Kyiv): Usually comes across as a humanitarian entity, yet still has potential in tech: algorithms, applied math, and data science.

Ukrainian Catholic University (Lviv): A leading institution for IT education in Ukraine (according to the UA’s largest IT community, DOU). It also ranks highly in other university assessments, such as the Forbes Ukraine rating, and has the highest average entrance score among all Ukrainian universities

Lviv Polytechnic and Lviv hub: The nearest university of appropriate level to Europe. Has many boutique product teams, micro-R&D studios, and cross-border delivery centers.

Kharkiv and Dnipro: Kharkiv has a legacy in telecom, embedded, and firmware engineering. Dnipro mixes industrial engineering with fintech shops focused on payments and banking integrations. Note that the cities suffer from Russian attacks more than Western Ukraine regions.

Rates and cost efficiency

We compiled Ukraine developer rates by matching the average at Upwork, Arc.dev, and PayScale. Total is around USD 25 to USD 55/hr for common stacks, but senior/specialized roles push above.

Comparison to Western Europe/the US and outsourcing maturity

Delivery speed and quality: Usually match Western delivery standards in code hygiene, CI/CD discipline, and test automation when they are staffed with senior engineers and organized into product-oriented squads. Internationally recognized vendors (like EPAM and GlobalLogic) use the same SDLC, SRE, and telemetry practices as Western delivery centers.

Collaboration nuances: Typically have a serious game in asynchronous work with detailed docs, automated pipelines, plus a propensity for synchronous touchpoints during overlapping CET windows. If you are from the US, here’s a trick for you: implement “follow-the-sun” handoffs or partial-shift coverage to secure a larger overlap.

Cost delta: Another specific feature is that you’d rather encounter higher rates than sketching stuffing practices when juniors are billed as seniors. But still, Western EU/US effective hourly costs are commonly 2-4x higher when fully loaded (including benefits and contractor premiums).

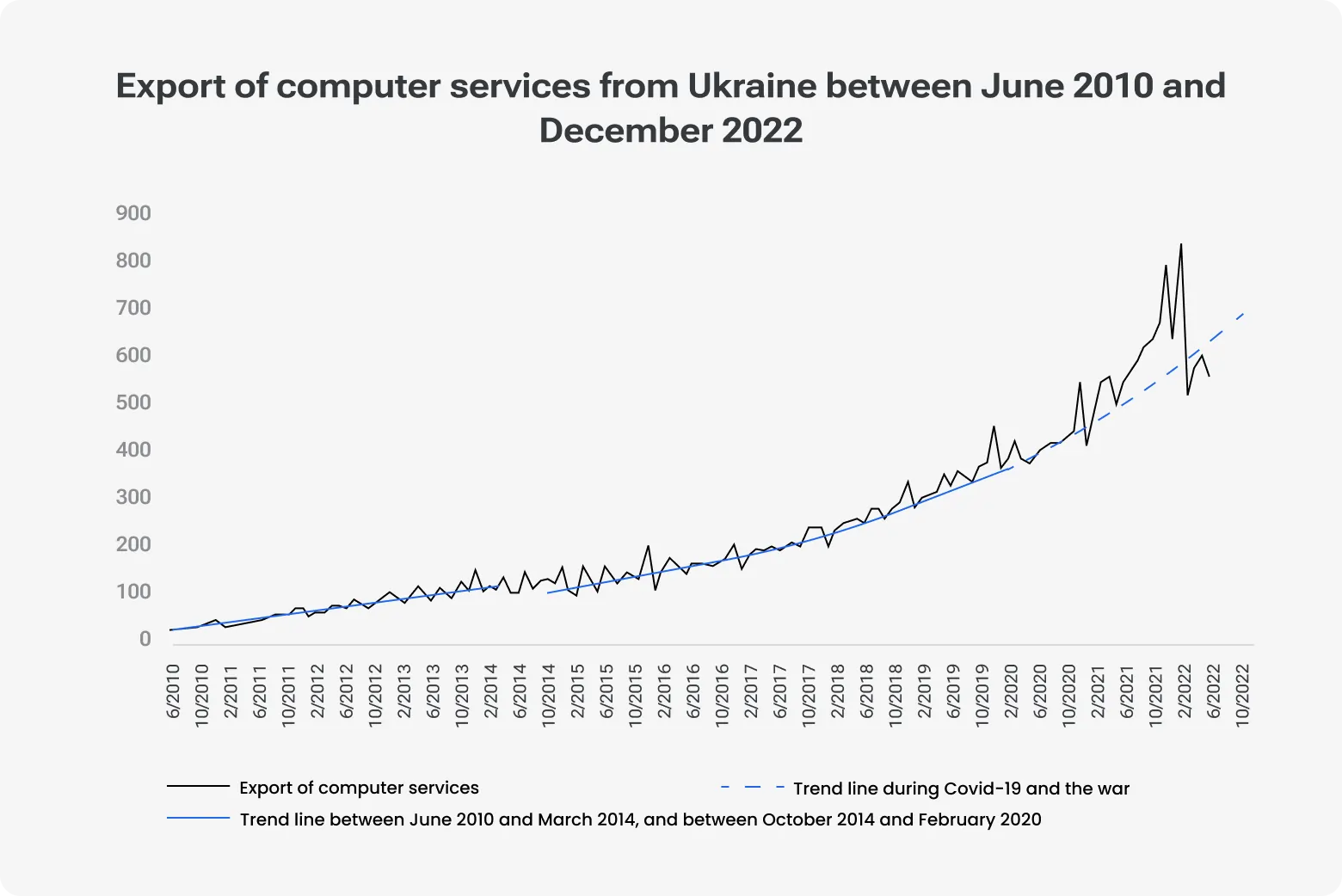

IT services are now the country’s #1 service export (USD 9.3B+ in 2024). Notably, the first half of 2025 showed a slight decrease in IT service exports, but the share of telecommunications, computer, and information services in total exports grew from 38.5% (USD 3.2 billion) to 43% (USD 3.3 billion).

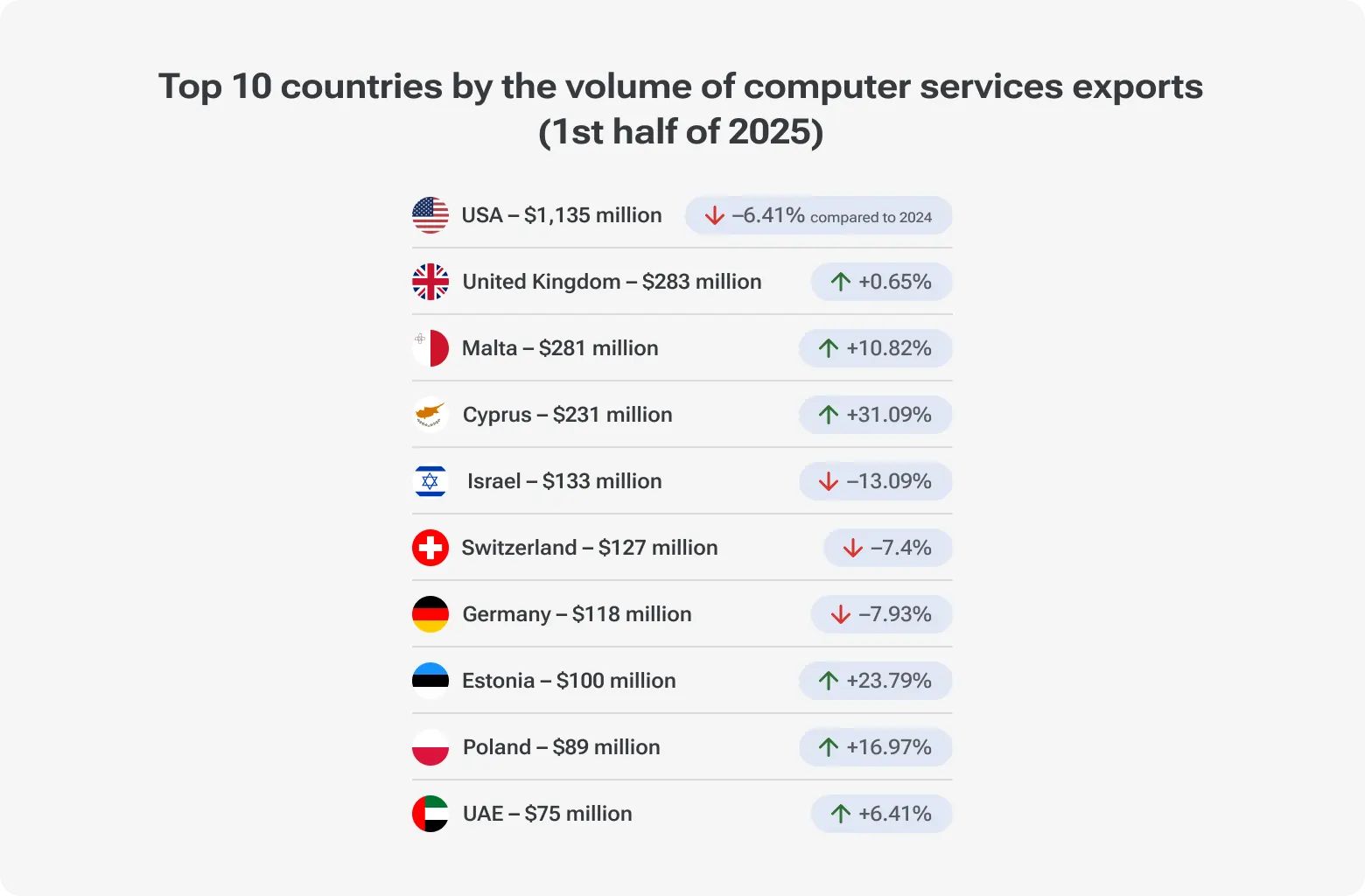

The top buyers were the US, UK, and Malta. Also, we should take into account the defense tech export that might be launched soon, which also implies specific services, like intelligence and similar ones.

Language and communication patterns

Not the highest proficiency even in Europe, but improving. #40 worldwide in 2024 and #29 in Europe, per EF EPI.

This is usually considered a moderate proficiency, but in practice, client-facing delivery teams and PMs typically operate in English. The most common and routine matters are discussed in text, and this way, you can definitely expect clear comms patterns and strong async artifacts (Confluence, RFCs).

Ukrainian engineers are autonomous, regularly review the code, and practice engineering-led decision-making. Approaches: Agile/Scrum or Kanban, with mature usage of CI/CD, code-quality gates, and cloud-native patterns.

Cultural compatibility

Cultural fit may not be the first thing clients investigate when outsourcing software development to Eastern Europe. That’s where many projects break down.

Ukrainian teams are schedule-aware and great at documentation (if we are talking about mature ones). Overall cultural fit with Western teams is high for companies that standardize rituals and align on SLAs.

Hire software developers in Ukraine

Global R&D presence

In the early 2010s, Ukraine became a Mecca for global software behemoths. And many of them are still running operations here: EPAM, GlobalLogic, Luxoft, SoftServe, and notable R&D labs (Samsung R&D, Deloitte team in the capital). These centers support enterprise SLAs and staff complex platform work.

Unique advantages

Business continuity and advanced resilience: All forward-thinking companies in Ukraine invested in multi-tier BCP — redundant offices, generators, Starlink, regional relocation benches, etc. National Bank and industry data show exports remained resilient in 2023-2024 despite infrastructure strikes.

Diia.City legal regime offers favorable IP, contract, and tax structures for IT service companies and product ones. More than 800 new residents in 2024.

Defense.City also launches soon — a special legal space for companies developing advanced technologies and hardware to protect the country’s sovereignty and freedom.

Niche expertise

FinTech and payments: Many mid-market banks use Ukrainian teams for ledger services and sometimes take consultations on launching humanized neobanks.

Machine learning/NLP: Product companies (like Grammarly, Respeecher, and others) and boutique ML shops deliver production-grade NLP.

Cybersecurity: Despite doubts about government services, private companies and service providers apply advanced security approaches and even adapt them to their wartime needs. Hardened SOC, threat intel, and secure-by-design application services — this kind of things.

Embedded and telecom stack: Telecom, in general, is becoming a Ukrainian signature move. This and computer and information services are the only three that showed a notable rise in exports in 2026. UA’s teams have deep firmware, real-time OS, and telecom protocol experience used in IoT and automotive subsystems.

Political (in)stability and energy resilience

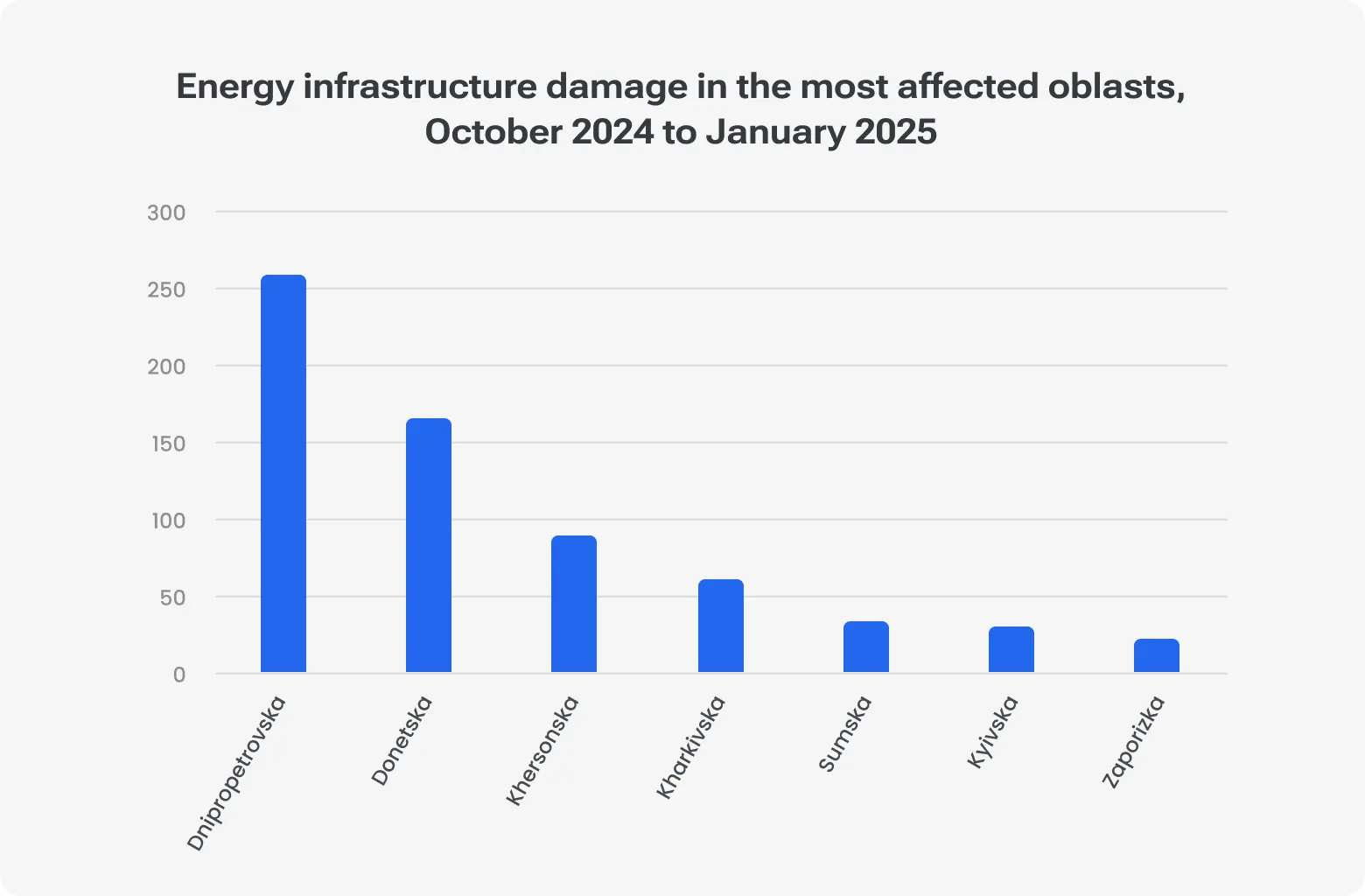

Eastern Europe outsourcing brings probably the boldest challenges in the world. War risk persists. Attacks on energy infrastructure remain a systemic risk, but industry and utilities have invested in redundancy and rapid restoration.

ACAPS investigated targeted strikes in 2024-2025 and notes significant recovery efforts and decentralized power solutions used by providers to keep services available.

Buyers should expect regionally targeted contingencies. Vendors typically maintain BCP (regional benches, backup power, cloud failover) to guarantee SLAs.

Challenges and ongoing risks

Mobilization: A lot of men in Ukraine encounter unfair treatment from the military institutions. This adds staffing planning complexity. How they mitigate: Hire lawyers, relocate those whom they can, hire abroad, and “reserve” from mobilization more people with lawyers’ support.

Talent churn and migration: Selective relocations to EU hubs and remote-work mobility increase hiring competition for senior ICs. How they mitigate: Simply use nearshore hubs, longer-term retention packages, and build bench capacity.

Operational planning under risk: Many urban centers saw improved grid stability in the last year. So, the practical playbook is geo-redundant teams + cloud-first infra + developer pods in multiple cities or EU nodes.

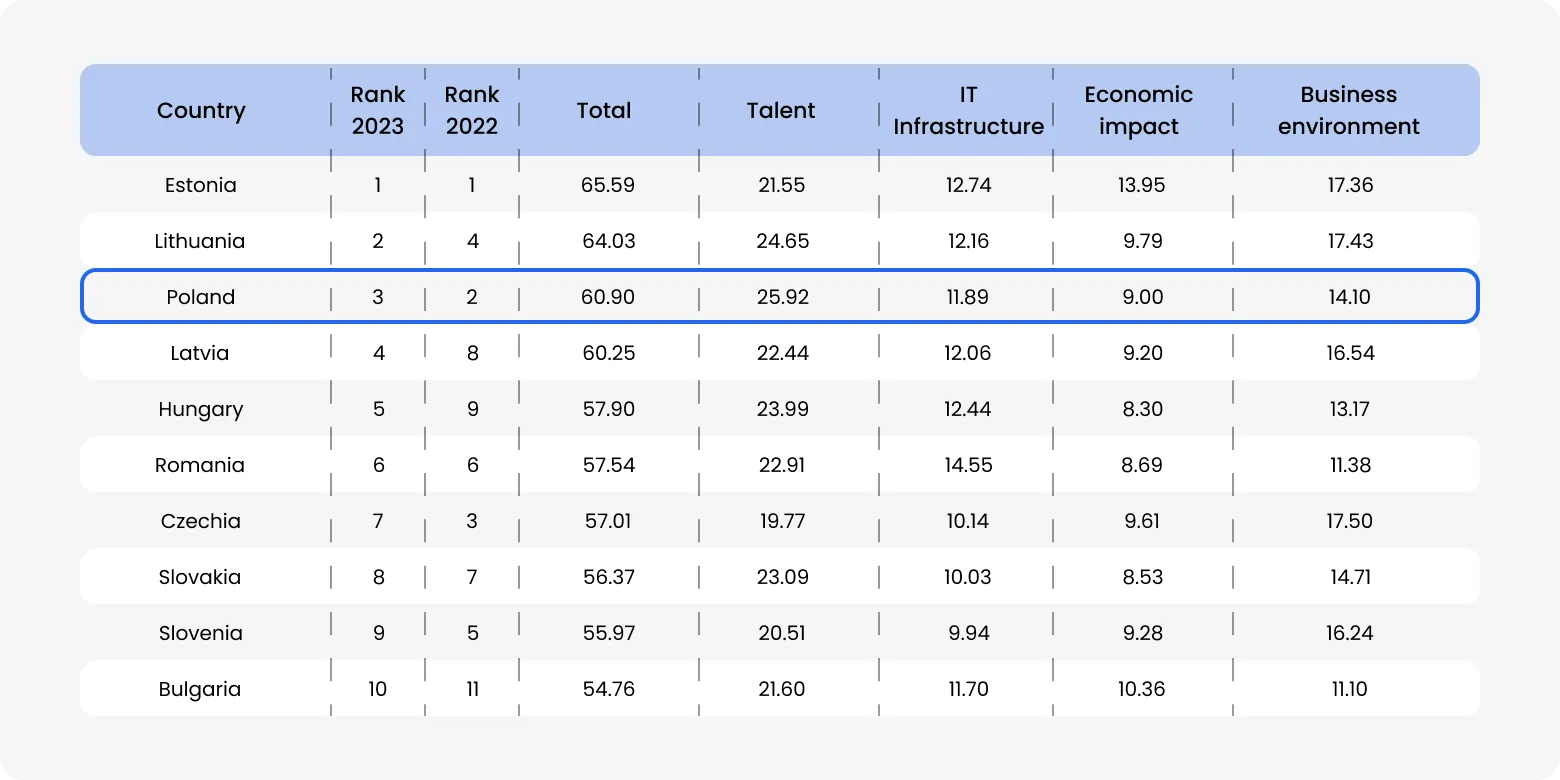

2. Poland

While more stable compared to Ukraine, Poland is becoming not only a significant powerhouse for outsourcing software development to Eastern Europe but also a pricey one. More than half a million IT professionals and a rising market (expected to hit USD 2.44 billion in revenue by the end of 2025), strong English proficiency, and GDPR compliance balance higher wages than in Ukraine and talent competition in hubs like Warsaw and Krakow.

Tech talent and education

Across Eastern Europe’s outsourcing market, Poland seems to be the most “delicious” provider with its large pool of IT professionals. Every year, about 15,000 ICT graduates start working in the industry in the three top-of-mind cities: Krakow, Warsaw, and Wroclaw.

Warsaw University of Technology: Known for its comprehensive programs in information technology, control and robotics, electronics, and telecommunications.

Jagiellonian University in Krakow: One of the oldest and most prestigious universities in Poland, with strong technology programs.

Wroclaw University of Environmental and Life Sciences: Focuses on engineering, technology, and environmental sciences, with a strong emphasis on innovation and sustainability.

Their CS grads are often snapped up by both outsourcing companies and product R&D teams. Training programs from Coders Lab, SoftServe Academy, and the Polish-Japanese Academy of Information Technology are making Poles native with Python, cloud, and modern JavaScript frameworks.

Developers and STEM pipeline

With over 520,000 professionals and 15,000 tech graduates entering the job market each year, the talent supply remains strong even amid global hiring competition.

The market is set to achieve a CAGR of 3.68% by 2030. At the same time, the revenue is expected to be USD 2.92B.

Rates and cost efficiency

IT outsourcing in Eastern Europe is generally more affordable than in the Western world. Many Western businesses find it a wise option to hire Polish developers as they won’t create legacy code from day one.

Also, Poland’s lower cost of living allows you to save up to 50% compared to other European and American markets. Just compare:

Development costs: The average salary for a mid-level software developer in Poland ranges from PLN 10,000 to PLN 18,000 per month (~ USD 4,000). And this is a salary offered by leading global companies (in local branches), so expect a slight decrease in local IT companies. Western Europe and the US usually have between 3x and 5x compared to this tag.

Delivery compared to Western Europe/US

Polish teams often match Western-led delivery quality: clean architecture, comprehensive test suites, AI integrations where relevant, and CI/CD.

Work alignment is easy — same or similar time zone as much of Western Europe, and decent overlap with the East Coast US for synchronous work.

Although there weren’t major and globally recognizable coding competitions that affected Western clients in their decision on outsourcing software development to Eastern Europe, in 2019, Poland ranked in the top 3 among the skilliest devs globally, according to HackerRank.

Domestic language and English proficiency

Polish is part of the Slavic language family. 97% of the local population chose it as their native language. You may think that Poles don’t speak international languages.

Not quite, because they definitely speak business language: Poland ranks 15th globally on the freshest EF’s English Proficiency Index, with most developers communicating clearly and confidently.

Cultural fit

Ethical enough to listen to your wishes, professional enough not to be yes-sayers. They often suggest improvements, are open in standups, responsive to feedback, and actually deliver.

Outsourcing maturity and financial trends

Poland has been in the global outsourcing business since the early 2000s. In 2026, several large service companies reported doubled profits year-on-year in Q1-Q3, even as global demand shifted.

Early 2025, Poland attracted major investments from Microsoft and Google to help giants enhance their cloud and AI capabilities.

Poland also ranks 33rd in the global startup ecosystem ranking by StartupBlink with 10.6% growth.

Global R&D presence

Google, IBM, Intel, Samsung, Cisco, and Microsoft have freelance teams and R&Ds here. We can also mention Citi, Accenture, and Procter & Gamble with their offices in major Polish cities. The most popular cities are Warsaw, Krakow, and Wroclaw.

Hire software developers in Poland

Unique advantages

EU membership, hand down. While Ukraine’s accession to the EU is being dragged out, Poland already boasts legal framework alignment, business predictability, and data privacy compliance.

Infrastructure: Highly reliable power, connectivity, and office options — until recently, less risk than some other Eastern European countries.

Final-mile proximity: Steady nearshore destination for Europe and must-keep-eye-on for Silicon Valley clients.

Niche expertise

FinTech and banking: PSD2, SEPA, and EU finance integration.

AI and cloud engineering: Poland has the largest number of AI companies in Europe, 301. Specifically, outsourcing vendors integrate AI-based analytics and automation.

Cybersecurity: GDPR-aligned systems and SaaS security audits.

Political and economic stability

Local multi-party democracy offers greater regulatory stability than many peers. Inflation in 2022-2023 didn’t hurt the IT sector’s growth, and it remained robust due to export demand.

Challenges

Still, growing wage inflation. Senior developers expect competitive perks and remote flexibility.

A crowded market in tech hubs means sourcing top talent demands screening and a good employer value proposition.

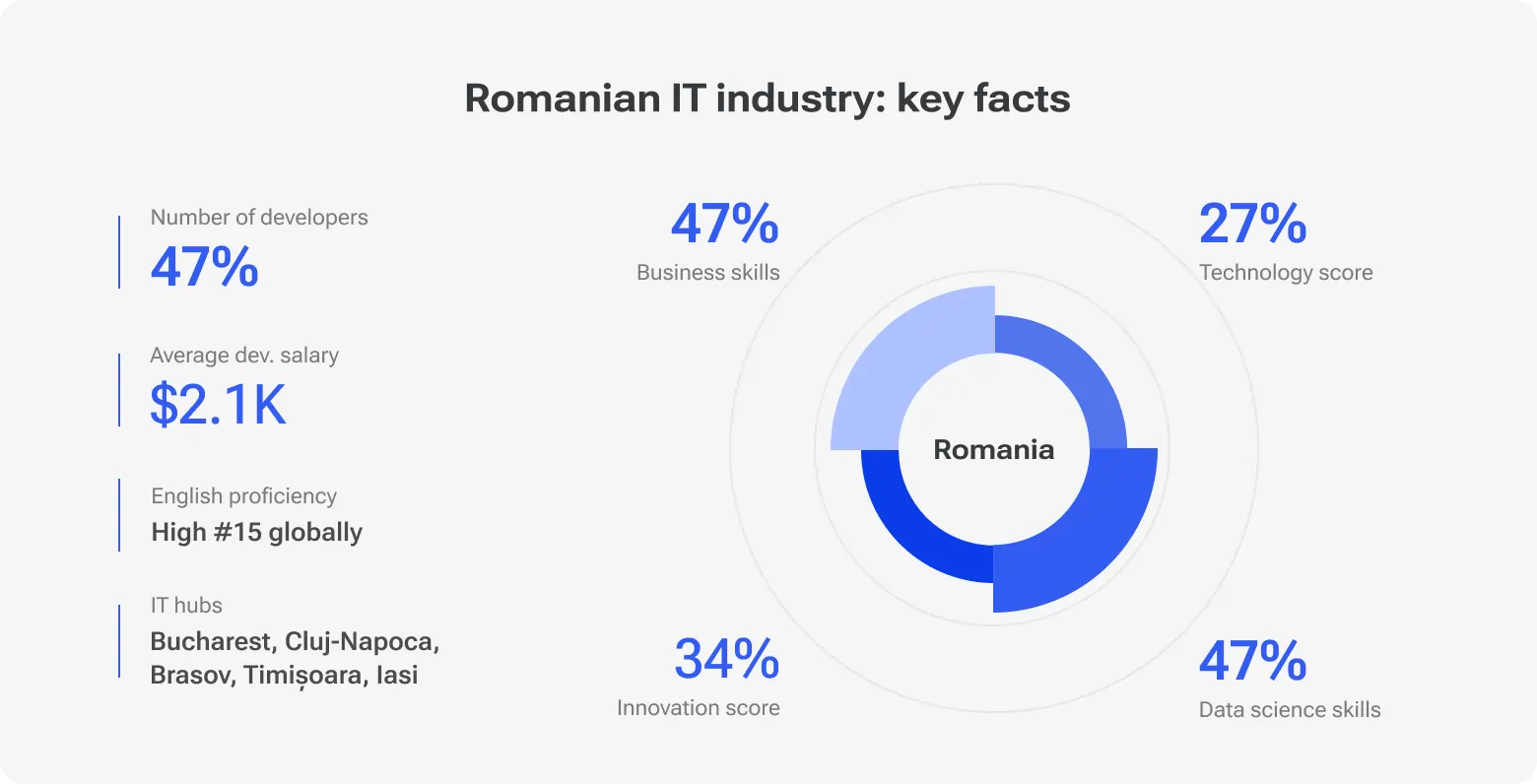

3. Romania

The country is one of the three leaders in software development outsourcing. Eastern Europe has 3.9 ICT companies per 1,000 residents. Just as a reminder, Western countries have 2.1 as an average.

Tech talent and education

We see a notable increase in dev pipelines over the last two decades. Growing investment in STEM, plus active employer-run academies, feed commercial delivery centers and product teams.

Key universities run special programs that nurture junior and mid-level engineers, and employer academies instill in the country the approach based on real, practical skills.

Developers and STEM pipeline

The range of the total number of software developers is around 190K. Might be slightly different if you change the method, the payroll vs. active contributors.

The number of STEM graduates is above Europe’s average, 29.1% vs. 24%. The total output: 9K-10K, backed by private bootcamps and returnees from EU/US diaspora programs.

Notable universities and tech hubs

Bucharest: Largest cluster with many R&D centres, scale-up HQs, and consulting practices. Politehnica and the University of Bucharest are the top-of-mind ones.

Cluj-Napoca: The “Romanian Silicon Valley” with a strong startup scene, rich in JavaScript/Java/T/Cloud talent.

Iași: Academic heavyweight with a focus on software engineering and data science. A go-to choice for healthcare, medtech, etc.

Timișoara: Has telecom and embedded systems history.

Rates and cost efficiency

USD 25-USD 45/hr range for mid-level developers and USD 45-USD 75/hr for senior specialists/niche roles. This is slightly higher than Ukraine’s lower bands but typically below Poland’s top tiers.

Delivery compared to Western Europe/US

Quality: Follows Western SDLC practices, CI/CD, test automation, code review, and DevOps pipelines. Telemetry and deployment SLAs are comparable to Western providers.

Collaboration patterns: Aligns with Central Europe on time. English proficiency = less rework from miscommunication. Flexible enough to arrange partial overlap of their hours with US clients.

Rate vs. output: Romania closes the “quality gap” to Western Europe and offers a 30-60% cost saving.

Domestic language and English proficiency

Romania ranks 10th in CEE and #12 globally in English proficiency. Client-facing teams, PMs, and architects operate in English.

Written artifacts and sprint rituals are typically English-first, especially in large providers. Local language (Romanian) is used internally but has little impact on client communication.

Cultural fit

Romanian teams combine continental European work patterns with a pragmatic, delivery-oriented mindset. Engineers are comfortable with Agile, push back when the scope is unclear, and provide technical recommendations. Excellent fit for Western European clients and acceptable for US clients.

Global R&D presence

Matured through the 2010s and gained scale after 2015, Romania got its name in global IT outsourcing. Eastern Europe, in general, attracted international nearshore investment at that time. Started hiring more actively in 2025-2026.

Global vendors and product companies have set up R&D and delivery centers: IBM, Amazon (AWS teams), Ubisoft, Oracle, and Intel.

Unique advantages

Romanians are commonly proficient in English, which reduces onboarding time and blockers

Recent repatriation programs add senior hires with Western product experience

Niche expertise

Cybersecurity and cloud security: Established companies and independent consultancies have strong capabilities in SOC, pentesting, and secure operations. Cloud & SI and BI & Big Data consulting take 7.3% and 5.5% of all services. Not that much, but it’s still a great share, considering almost 200K tech professionals and 400+ ICT companies.

E-commerce and retail platforms: Mature teams creating high-traffic platforms and integration with EU payment rails.

Automation and RPA: There is an entire ecosystem for workflow automation projects.

Political and economic stability

As an EU member with standard EU regulatory frameworks, you can rely on legal predictability. The government has taken measures to shore up public finances in 2025-2026 (tax compliance programs). Yes, macro pressures exist, but the IT sector seems like a priority for the government at its current state.

Challenges

Talent competition: Cluj and Bucharest are competitive markets, but successful buyers often use center/diversified sourcing (Iași, Timișoara) and retention strategies (career paths, equity, learning budgets). Also, expect a slight rise in pricing.

Macro fiscal shifts: Potential tax or compliance changes could affect vendor margins. This is what we already said above. So, it’s worth including contract clauses for long-term projects that address reasonable tax/regulatory pass-throughs.

Scale for massive staffing needs: Romania has fewer total devs than Poland.

Hire software developers in Romania

4. Bulgaria

The country is not an undisputed leader in Eastern Europe’s software development, but the government has done a good job. In 2016, only 18% of local citizens had basic digital skills. In 2025, the number hit 35.5%. Even though it is still below the EU’s target, we can expect a faster pace in the coming years.

Tech talent and education

When the overall population is 6.4 million, you can’t expect a large number of skilled techies. Yes, the local tech community is compact but concentrated.

The country’s CS departments and engineering schools feed both product companies and outsourcing shops. Employer-led academies (Progress/Telerik Academy, SAP training tracks, VMware onboarding programmes) mean recruiters can source engineers familiar with enterprise stacks and product lifecycles straight out of training.

In 2022, the government launched the Digital Bulgaria 2025 National Programme, which introduced three priorities in digital literacy: Modernization of school and higher education, growing the number of skilled ICT specialists, and improving average digital literacy among the people.

Developers and STEM graduates

The rough number of software devs in Bulgaria is 120,000, where 66K are in outsourcing. And we see a growth trend: Developer headcount has been rising ~5-8% annually over recent years, driven by export demand and scaling of R&D centres.

University STEM output plus private bootcamps add roughly 8K-12K tech graduates a year into the funnel.

Notable universities and tech hubs

Sofia (primary hub): Largest concentration of product R&D and delivery centres. There are global R&D centres, like VMware (one of EMEA’s largest R&D hubs), SAP Labs, Progress Software (Telerik roots).

Plovdiv and Burgas: Relatively fresh clusters for nearshore delivery and engineering capacity, attractive for lower-cost scaling.

Varna and Veliko Tarnovo: Usually are more preferred for telecom, embedded systems, and university-driven research projects that occasionally feed into export-grade initiatives.

Rates and cost efficiency

Comparing Bulgaria with other countries in Eastern Europe, outsourcing in this country is growing its share in GDP, but still has delectable rates, lower than in Poland, but slightly higher than in Ukraine (but again, it depends — some guides place Bulgaria and Ukraine in a row). The band depends on seniority and stack:

Junior: ~USD 20 - USD 30/hr

Senior/Architect: ~USD 50 - USD 80+/hr

Delivery compared to Western Europe/US

Delivery practices: R&D centres run on the same engineering playbooks used in Western Europe — CI/CD, trunk-based development, automated testing, code ownership, and SRE.

Collaboration nuance: Bulgarian teams combine high English capability with EU-business habits (straightforward scheduling, EU-friendly legal terms, mature procurement processes, etc.) The “cost of coordination” is minimal, as you see.

Domestic language and English proficiency

Bulgaria ranks #16th on EF’s English Proficiency Index (Sofia scores especially well, with a “very high” overall level).

PMs and senior engineers typically operate in English, written deliverables and sprint artifacts are usually English-first. Rest assured, there will be clear written status, well-formed RFCs, and minimal ambiguity in requirements communication.

Cultural fit

Sofia and other Bulgarian cities are close to US/European business norms. You can expect predictable meetings (with agenda, follow-ups, etc.), formalized planning, and delivery commitment. Teams are pragmatic, prefer explicit acceptance criteria, and generally accept Western-style performance management and accountability practices.

Outsourcing maturity and market performance

Bulgaria’s software sector shows sustained growth: IBISWorld reports an 8.2%+ CAGR for software development companies and an expanding number of specialized outsourcing companies. This can be partially explained by global R&D expansions and scale-ups.

Example: The Bulgarian branch of VMware has grown into one of EMEA’s larger R&D centers. A few years ago, Broadcom acquired VMware for USD 69 billion.

Global R&D presence

Apart from VMware, there are many other companies you definitely know and that have local offices in Sofia, Varna, and Plovdiv.

A couple of them: SAP Labs, Hewlett Packard Enterprise, Microsoft, Cisco. This is not to mention smaller R&D centres and partner ecosystems for Honeywell, Google, and others. Global vendors trust Bulgarian engineering for cloud, middleware, and enterprise tooling as they provide both senior talent and transfer of Western engineering culture.

Unique advantages

Enterprise-level R&D: Large vendor R&D centers create a sea of opportunities to choose from. On the one hand, it’s about trust and double-checked location/industry. On the other, it’s about specific skills you are looking for: product thinking, consistency, and thoughtful roadmaps.

EU regulatory parity: Easier contracts, IP clarity, and GDPR alignment.

Balanced cost-to-quality: Slightly higher than the cheapest CEE options, but with less risk and stronger enterprise process maturity.

Niche expertise

UI components and languages: The most popular languages are JavaScript, C#, Python, SQL, PHP, and .NET. Expect also advanced level of UI libraries and developer tooling usage.

Cloud and virtualization engineering: Core hypervisor and cloud management features, which is a sign of high-skill systems engineering.

Enterprise apps and SAP ecosystems: SAP Labs has an office in Sofia, so rest assured you’ll find SAP devs and localized R&D for enterprise modules and integrations.

Regarding niches themselves, we can highlight healthcare, travel, insurance, education, and telecommunications.

Political and economic stability

Bulgaria is an EU and NATO member. This delivers legal predictability and access to EU funding programs for tech. Of course, macro risks exist, but the investment climate for R&D has been friendly in recent years. So, there is no more risk than anywhere else.

Challenges and mitigations

Scale constraints: The total developer pool is smaller than in Poland or Romania. Got a plan for world domination? You may need multi-country sourcing then.

Talent concentration in Sofia: Sofia has a population of 1.2M, and the nearest city, Plovdiv, only has around 370K. Therefore, you can expect local wage pressure. Target regional cities and use contractor networks to mitigate this.

Market visibility variance: Not every vendor is export-focused, so deeper technical due diligence will come in handy.

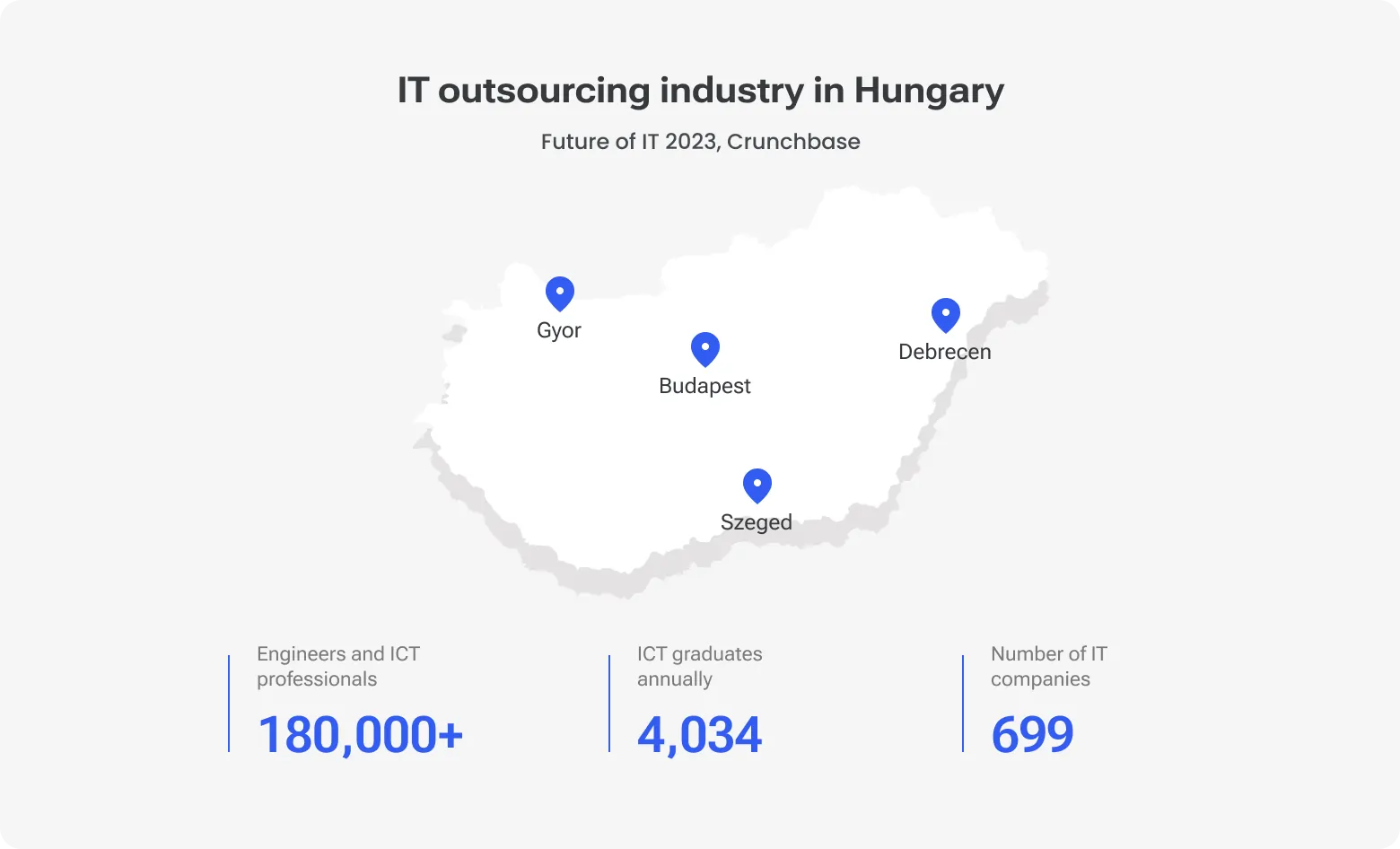

5. Hungary

Hungary probably is not the first country that pops up in your mind when talking about IT outsourcing. Eastern Europe has way more popular destinations for this reason. However, this country has its legs. Let’s break down what exactly.

Tech talent and education

Unexpectedly, Hungary is a full-fledged Central-European hub for product R&D and scale-ups. Yet, this is not that sudden, as Eötvös Lorand University (ELTE) and Budapest University of Technology and Economics (BME) have been supplying strong CS, applied maths, and systems engineering talent for years.

Private academies and corporate training tracks are also upgrading, shortening the “supply chain” cycle, from educational entity to real-world engineering challenges in months.

Developers and STEM pipeline

Tough to find the actual and proven total number of developers in Hungary, especially if you want to group them by languages, frameworks, niches, etc.

Roughly, there are 180K devs, depending on whether you count only software engineers on payroll or the broader ICT workforce. Let’s lock in the mentioned industry-average.

Annual STEM output is modest — about 6,000-8,000 CS/EE graduates every year.

Notable universities and tech hubs

Budapest: Ranks 31st in Tholons Services Globalization City Index, which benchmarks cities based on their global service industry potential. R&D presence, startups, and venture activity — total ~130 software development companies. Hosts Brain Bar and Startup Safari.

Debrecen / Szeged / Pecs: Strong university towns that grow specialized talent in bioinformatics and embedded systems. Szeged and Debrecen have active CS/AI research labs.

Tech clusters and incubators: Startup Hungary and programs tracked by Startup Hungary aggregate investment flows and map active founder networks. So, if you need product-oriented engineers with growth/scale experience, this is your go-to choice.

Rates and cost efficiency

The main selection of outsourcing companies has a rate range between USD 25/hr and USD 99/hr. Yet, in practice, local rates are USD 30/hr - USD 65/hr — average tag for software development outsourcing in Eastern Europe.

Delivery compared to Western Europe/US

Delivery maturity: Hungarian delivery centers typically operate modern SDLCs with CI/CD, SRE practices, automated/autonomous testing, and shared insights.

Collaboration patterns: Perfect overlap with EU clients and reasonable partial overlap for the US East Coast. English level allows Hungarian providers to keep bilingual documentation.

Rates vs. final value: 30-60% lower than in Western Europe and even more compared to the US. Frankly, the outcome parity depends on how many senior roles you place onshore vs. offshore and how strictly you enforce engineering KPIs.

English proficiency and communication patterns

#17 globally and #15 in Europe, according to EF EPI. You can count on reliable spoken and written English among client-facing engineers and PMs with clear standups, structured RFCs, and professional documentation.

Cultural fit

More autonomy and less formal planning, as agile is common, and teams are comfortable with engineering ownership models used by Western product orgs. Hofstede’s cultural dimensions analysis of Hungary’s typical working culture:

Achievement motivation score — 88/100

Individualistic tendency — 71/100

Uncertainty avoidance score — 82/100

Power distance score — 46/100

Outsourcing maturity and market performance

Global companies are trying to cut costs and are looking for new destinations where software development is cheaper. So, the Hungarian ICT market is gaining ground with a strong projected CAGR of 9.8% to 2030. Many R&D centers and VC-backed product teams supply both scale and product domain expertise to buyers.

Global R&D presence

Continuing the R&D topic, global players didn’t neglect Hungary, looking for Eastern Europe’s software development. Eventually, you get a senior transfer, mentorship opportunities, and a pool of enterprise-grade-tested engineers. Industry and startup reports record steady FDI into Hungary’s tech scene for a couple of years.

Unique advantages

Strong math/algorithms base: Good for ML, data engineering, quant fintech work.

Startup + enterprise mix: Product Engineers who can build MVPs and harden platforms.

Time zone and EU legal alignment: Simple contract footprints and easier vendor management.

Niche expertise and example use cases

Fintech: Sharing the niche with Ukraine and Poland, yet EU-aligned compared to the former and cheaper compared to the latter. Modern cyber challenges drive demand for secure engineering.

AI and data engineering: Active university research and corporate ML teams push competence in recommendation systems and NLP.

Embedded systems and telecom: Legacy telecom engineering plus regional automotive suppliers.

Political and economic stability

Inflation and some EU funding frictions have created policy uncertainty, but ratings agencies and some forecasts assert that the market will remain open to investment in tech and R&D.

Buyers should monitor macro headlines (EU funding relations, fiscal policy) but can still trust standard contracting and IP frameworks for Hungary-based engagements.

Challenges and mitigations

Size of the pool vs. scale needs: Smaller than Poland and will need combined outsourcing models for larger staffing needs.

Macro policy noise: Potential fiscal and funding volatility requires contract clauses for long projects.

Comparison table

Quick scanning arrived — a comprehensive table summarizing the article. But for complex understanding, please check the sections above.

Country

Avg. hourly rate, USD

~ Number of developers

English level

Time zone

Political stability

25-55 (senior and niche >USD 80)

#40 worldwide, #29 in Europe. In fact, all client-facing teams have at least B2

Ongoing war, but there is strong sector resilience and BCP practices.

35-70 (senior USD 90 - USD 110)

#15 worldwide, #13 in Europe

EU member with high regulatory stability, GDPR alignment.

#12 worldwide, #10 in Europe

Stable, currently improving R&D investment and repatriation.

#16 worldwide, #14 in Europe

Stable legal environment.

Too wide range per different assessment rules: 90K to 180K

#17 worldwide, #15 in Europe

Mixed: generally stable for contracts but monitor macro / political headlines.

Conclusion

The main reason why Western giants and forward-thinking companies are sizing up Eastern Europe for outsourcing is rising costs. Energy, cost of living, digital resources, and economic instability.

But there is a trick. Sometimes, a chosen location can impact the project beyond just technical ability — cultural nuances, mentorship capabilities, and overdelivering really matter in IT outsourcing. Eastern Europe can offer and can actually deliver.

Scan the table, dive deeper in sections, and book a call with Devico experts for mature guidance.